ICA Ambassador to Colombia

ICA Ambassador to Colombia

I am very pleased to present this important information on the state of the Colombian emerald industry. It is the first submission in my new role Ambassador to Colombia for ICA, and I would like to extend a very special Thank You to Guillermo Galvis, president of ACODES, for his professionalism and continued collaboration, and who is responsible for this very comprehensive report.

By Idolfo Romero

(Romero is a Colombian lawyer, specializing in the mining industry, with particular emphasis on issues relating to the exploration, exploitation, processing and marketing of mineral resources. He is also an active member and advisor to APRECOL, the emerald producers’ association, one of the three groups united under Fedesmeraldas, along with ACODES and ASOCOEMERAL.)

Colombia has been changing over the last few years. The nation has seen new investments in mining, a whole new legal framework for the emerald trade and a new generation of leaders from the government to the mining industry, thus creating a new landscape in the industry. Part of the story will be presented at the upcoming Second World Emerald Symposium that continues a successful series started in 2015.

Mining

Muzo Mine, the very first international corporation that invested in Colombia in 2010, today reports strong results for all its divisions: mining, cutting and selling in the retail market with a premium partnership with Argyle Diamonds in Australia, which is rocking the high-end market with exquisite pieces of very exclusive pink diamonds and ultra-fine Colombian Muzo emeralds.

This year, more good news is coming out of Colombia. Fura Gems is developing Coscuez, the very iconic mine that produces large quantities of emeralds in impressive large sizes, ranging from medium to high quality. Coscuez is one of the main sources of Colombian emeralds, and the mine has produced the green gems for more than 500 years. With Fura, Coscuez will bring to market a sustainable and regular supply of emeralds to the industry.

There are also several other new mining operations in the country, from the western to eastern belt that will also contribute to meeting today’s high demand for the precious green stones.

Trade

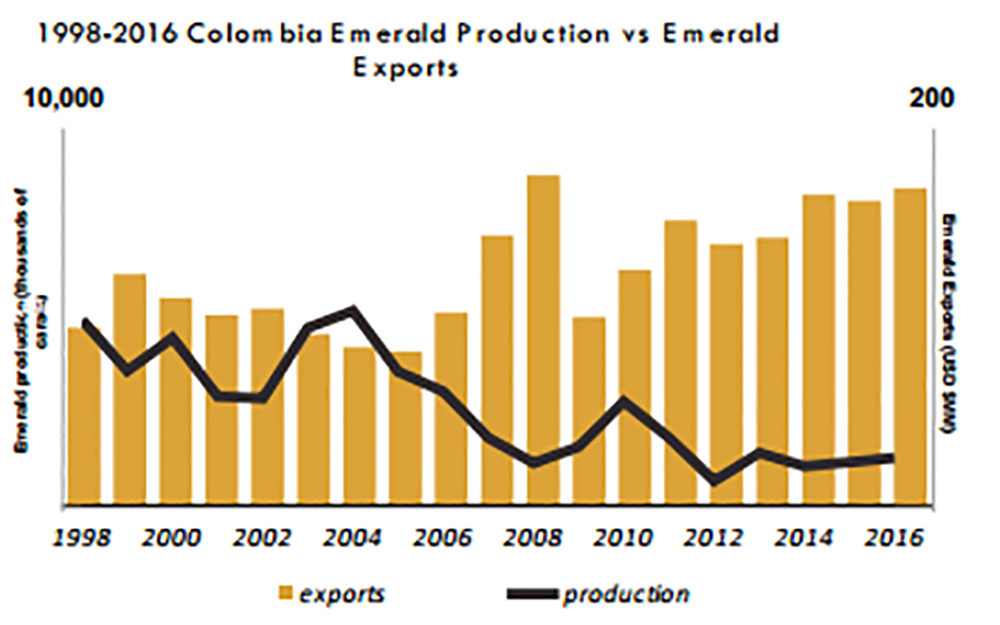

The emerald market in Colombia continues to show impressive export results, with a growth of about 50 percent over the last five years in value terms. It has achieved these remarkable results in spite of the worldwide slowdown in gemstone production.

Although there is less output, the main mines all are active. High quality gems are coming out of Chivor, Gachala, Cunas, Coscuez and Muzo. Buyers come all year round to the downtown market and we note the presence of more Chinese and Asian buyers than in previous years. The USA and Europe are the main players in Colombia’s emerald market.

CDTEC (The emerald research and gemological center sponsored by the government and the Colombian industry) will officially launch this year at the Second World Emerald Symposium. It will address long-term developments in emerald treatment, and offer a natural solution for the problems faced by emeralds in the last decades due to enhancements.

Marketing & Collaboration

This emerald and diamond and ring represents the premium collaboration between Colombia's Muzo Mine and Rio Tinto's Argyle Diamonds in Australia.

CSR and Traceability

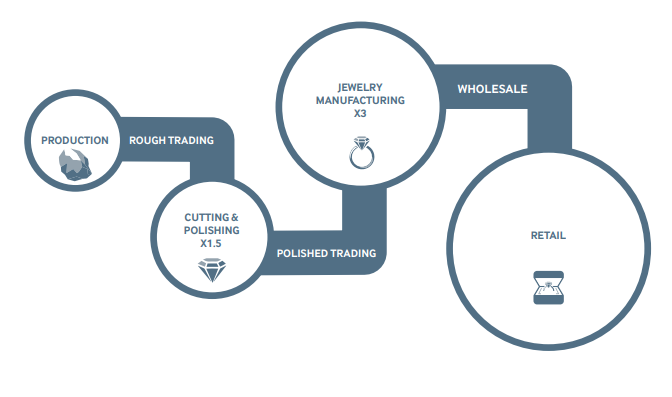

From the national government to local authorities and private companies, regulations in the emerald trade have been changing in relationship to mineral origin, traceability, financial and corporate due diligence. This is not unlike the disruptions happening in the gemstone industry worldwide. New regulations require every element of the supply chain to belong to and comply with RUCOM (the national register for the mineral trade), as well to adhere to all the national financial procedures of due diligence before any gemstone can be exported or sold in the country.

Public Policies and Sustainability

For more than 20 years, the guild has understood that being united can achieve more. Thus, Fedesmeraldas was formed, bringing together, under one umbrella, mining associations, dealers’ groups and exporters. A National Emerald Fund was also created that takes one percent of export value to reinvest in promotion, research and social development in local communities. Last year, Fedesmeraldas announced a US$2.6 million investment in a first-level Muzo hospital, along with several other educational initiatives in Chivor and the western belt. Together with private corporations, real solutions are being brought to local communities, providing a good model for the gemstone market.

Thanks to a very generous invitation from ICA and the Indian industry (GJEPC), Colombia attended the ICA Congress in Jaipur in October 2017. This was an educational opportunity for us, and we learned about public policies in the world’s major producing countries and markets. We discovered very interesting models and initiatives, which can lead to better harmonization with public policies. For example, Thailand has Zero VAT, as well as favorable customs and duties that promote more imports and exports. Its jewelry and gemstone sector was worth US$15 billion in 2017, and is responsible for 3.5 percent of the nation’s workforce. As another example, India’s gem and jewelry industry reached US$45 billion, showing that a good marriage between trade and government is essential to the long-term health of the industry. Thirdly, Brazil has a mono-tribute that solves a big problem of taxes while formalizing the situation of artisanal miners and bringing traceability to the trade. And we learned that Zambia has shown the world how good policies relating to mining investment give positive results for an industry that was created in less than a decade. Finally, Colombia can demonstrate to the world that having the mining, trade and export sectors adhere to mining, trade and financial regulations will create a perfect scenario for investment in an old industry to supply demand requested by the whole world.

We believe that worldwide efforts in mining, public policies, best practices and trade need to be consolidated, so that each member of the emerald industry can learn and share for the betterment of the sector. The Second World Emerald Symposium, in Bogota from October 12 to 14, 2018, will be part of these efforts to strengthen the global emerald industry to face the challenges and grasp the opportunities in the luxury industry that continues to embrace gemstones more and more.

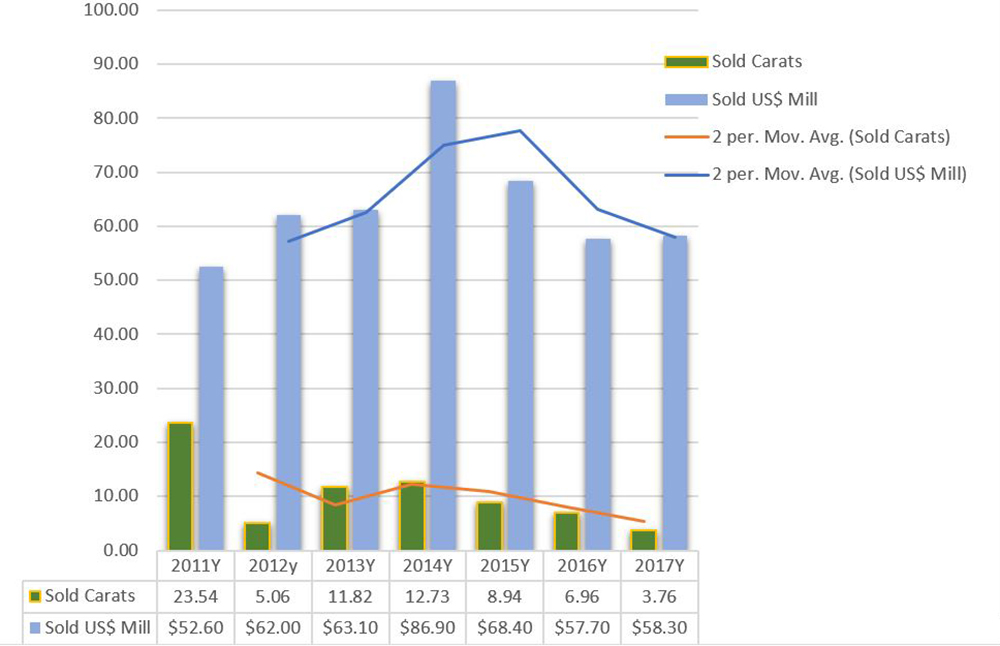

The overall exports of Colombia by value are still strong. Compared to such major producers as Gemfields, they offer an interesting revenue level, which gives hopes to new miners, investors and traders for the future of the Colombian emerald industry.

Comparison of International (Kagem) and Colombia Production VS Exports

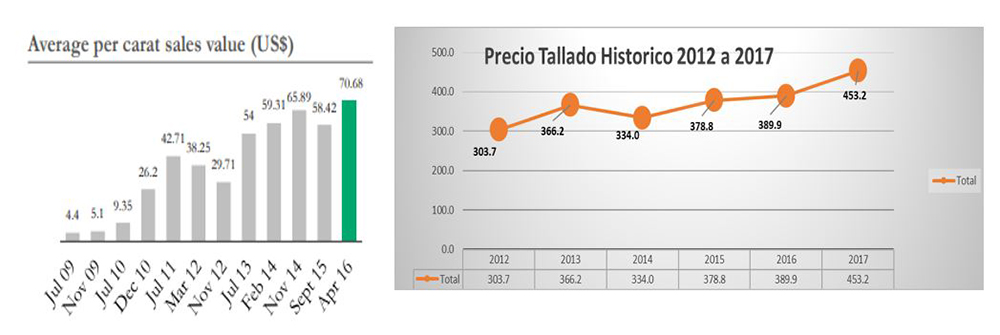

These statistics indicate that the Colombian market keeps growing in terms of per-carat prices, even with a slowdown in production. In Zambia, production is also slowing down, but they have a slightly lower price correction.

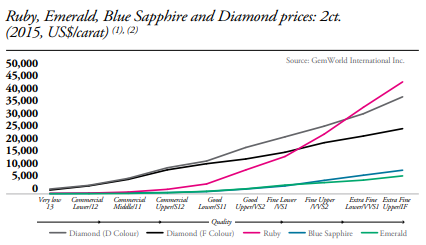

Emeralds in sizes of 2 carats and above still have long ways to grow, against ruby, sapphire and diamonds.

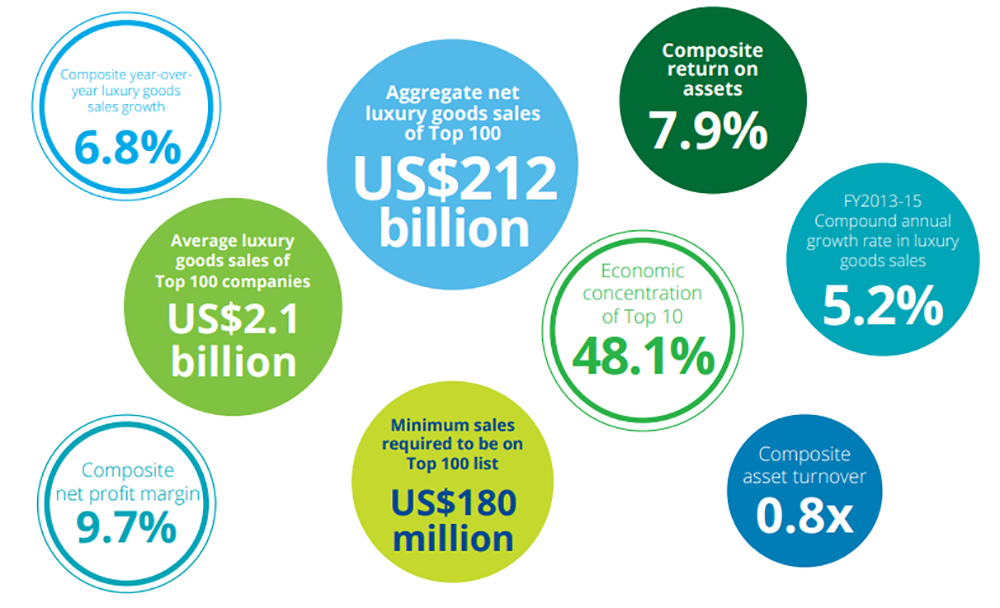

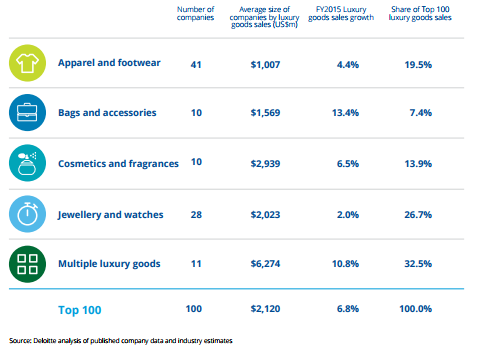

The jewelry market accounts for 26.7 percent of the US$500 billion luxury market. Emeralds are less than 0.01 percent of this global market, showing that they have a huge potential for growth. This is important in understanding the horizon ahead.

Important differences in the prices between similar kinds of Colombian and African material prove that the Colombian industry adds value to emeralds.